The closer you are to the money creation, the more you benefit” – Richard Cantillon 1680-1734

What is the Cantillon Effect?

The Cantillon Effect, named after the 18th-century economist Richard Cantillon, is a phenomenon that examines the uneven distribution of newly created money within an economy and its profound financial and economic implications. Understanding the dynamics of this effect is crucial for comprehending the challenges posed by wealth inequality and the potential consequences on economic stability.

As the world increasingly embraces digital currencies, particularly cryptocurrencies like Bitcoin, it is crucial to examine how they offer unique advantages in combating the Cantillon Effect and its subsequent financial and economic impacts.

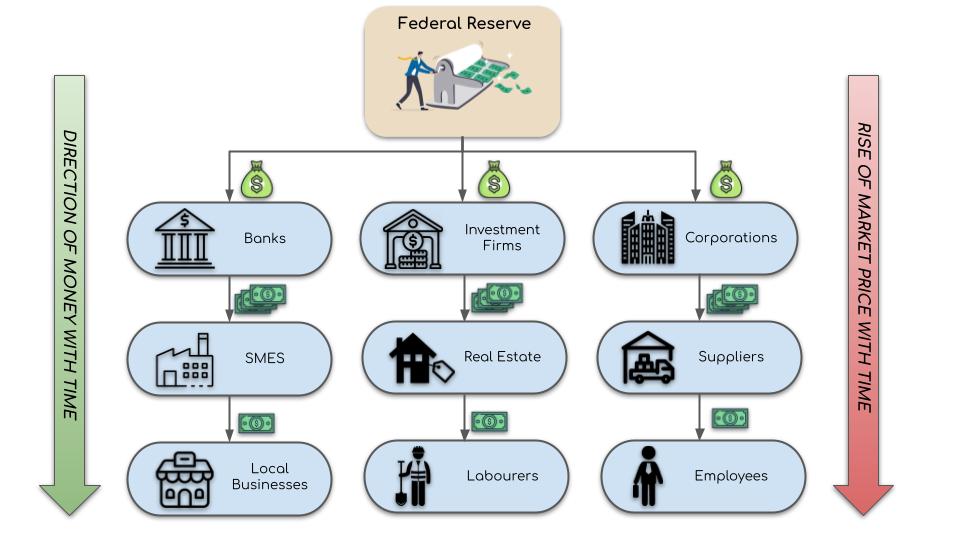

Image 2. Illustration of Cantillon Effect redistribution process in the US

Money printing exacerbates inequality

The Cantillon Effect delves into the consequences of monetary injections and the subsequent uneven distribution of newly created money. When central banks or governments increase the money supply through measures like quantitative easing or fiscal stimulus, the initial recipients of the newly created money gain a significant advantage. Taking the US Economy as an example (reference Table 1 above), as the FED prints more money and injects capital into the system the first recipients are at the top of the pecking order, namely: banks, investment firms and corporations.

This early access allows them to spend or invest the funds before prices fully adjust, resulting in such institutions grasping the early benefits of the newly printed money before anyone else in the chain has a chance to receive and potentially invest any new funds. Inevitably, this exacerbates wealth distortion giving all the players at the top of the financial chain all the benefits and competitive advantage over everyone else depicted below, most notably the masses of individuals and families sitting at the bottom of the money redistribution process.

The primary mechanisms that drive the Cantillon Effect are as follows:

- Asset Price Inflation: The injection of new money often finds its way into financial markets, leading to increased demand for assets such as stocks, bonds, and real estate. As a result, asset prices rise, benefiting those who hold these assets and exacerbating wealth disparities.

- Consumer Price Inflation: The newly created money eventually flows into the wider economy, leading to increased consumer spending. However, as the money supply expands faster than the production of goods and services, inflationary pressures arise, eroding the purchasing power of those with limited access to the newly created money.

- Wealth Redistribution: The Cantillon Effect contributes to a skewed distribution of wealth as the initial recipients of the newly created money, typically financial institutions and large corporations, gain a significant advantage over others. This uneven distribution perpetuates income inequality and limits economic mobility.

Wider implications of the Cantillon Effect

The Cantillon Effect has several noteworthy implications for financial systems and economies:

- Wealth Inequality: The uneven distribution of newly created money widens the wealth gap, concentrating resources and power in the hands of a few. This inequality can hinder social mobility, exacerbate socio-economic disparities, and undermine the overall stability of an economy.

- Market Distortions: The influx of newly created money can distort financial markets, leading to speculative bubbles and unsustainable asset valuations. This can create systemic risks and potentially result in financial crises.

- Economic Stability: The Cantillon Effect has the potential to disrupt economic stability by fueling inflation and eroding the purchasing power of the general population. It can also hinder long-term investment and productive capital allocation, negatively impacting economic growth and sustainability.

In the wake of the Cantillon Effect, a significant transformation has taken place in wealth distribution. The modern central banking system allowed a privileged few—the top 1%—to capitalize on newly created money, investing it in assets like stocks and real estate. This initial advantage magnified their wealth while ordinary wages stagnated, leading to a deepening wealth gap with the bottom 90% of society as clearly illustrated in the following diagram.

Diagram 1. – Share of total net worth: Bottom 90% vs Top 1%

Source: Board of Governors of the Federal Reserve System (US)

The Cantillon Effect acted as a catalyst, driving the rich to accumulate assets that rose in value, while the majority faced eroding purchasing power as the benefits of newly created money were diluted by the time it reached them.

How cryptocurrencies can address inequalities

Cryptocurrencies, such as Bitcoin, offer a unique proposition in combating the Cantillon Effect due to their inherent characteristics and decentralized nature. Here are a few key factors contributing to their potential superiority in this regard:

- Limited Supply: Unlike fiat currencies, many cryptocurrencies, and most notably including Bitcoin, have predetermined maximum supplies. Bitcoin, for instance, is capped at 21 million coins, ensuring scarcity and avoiding arbitrary inflation. This fixed supply inhibits the centralization of wealth and prevents government-controlled money supply expansions that can lead to the Cantillon Effect.

- Transparent and Immutable Ledger: Cryptocurrencies rely on blockchain technology, providing an open and transparent ledger of all transactions. This transparency mitigates the risk of arbitrary money creation and allows for greater accountability. The immutable nature of the blockchain ensures that transactions cannot be altered retroactively, further strengthening trust and reducing the potential for manipulation.

- Decentralisation and Financial Inclusion: Cryptocurrencies operate on decentralized networks, eliminating the need for intermediaries and central authorities. This decentralization empowers individuals, regardless of their geographic location or financial status, to participate in the global economy. By providing financial inclusion, cryptocurrencies reduce the impact of the Cantillon Effect, fostering a more equitable distribution of wealth and economic opportunities.

Final Thoughts

The Cantillon Effect has long been recognized as a consequence of monetary policies and their impact on price inflation. Specifically, it illuminates the consequences of the uneven distribution of newly created money, highlighting its impact on wealth inequality, market distortions, and economic stability. Recognizing the existence of this effect is crucial for policymakers, economists, and society as a whole.

Some Cryptocurrencies, like Bitcoin, with their limited supply, transparent ledgers, and decentralized nature, hold great promise in combating this effect and promoting a more balanced and fair economic landscape. By embracing digital currencies, individuals and economies can reduce the risk of arbitrary inflation, wealth concentration, and unfair distribution of newly created money.

However, it is important to note that while cryptocurrencies offer advantages in combating the Cantillon Effect, they also face their own challenges, such as price volatility and regulatory uncertainty. Continued research, innovation, and collaboration among governments, financial institutions, and cryptocurrency communities are essential to unlock the full potential of cryptocurrencies and harness their superiority in addressing the complex issues surrounding the Cantillon Effect.