Photo Source: Giphy

Anything available in unlimited supply sees its (economic) value converge to zero like is the case with air, sand and so on. The increasing rate of monetary base may well result in its value converging to zero too.

As Investopedia neatly describes it, the Money Supply is “all the currency and other liquid instruments in a country’s economy on the date it is measured”. In other words the money supply is the sum of all cash and other non cash items that are “liquid”, or easily convertible into cash such as deposits and loans.

Why is money supply important?

In the context of getting deeper into our understanding of how economies work and how currencies derive their value, money supply is a very important factor. Controlling the money supply is crucially important in managing an economies’ overall health, the rate of inflation and the associated value of a currency.

Lets break this down:

- Economy Health and Growth – Having sufficient liquidity in an economy is an important factor in order to support the growth of such an economy for instance through the availability of sufficient money to be available for businesses to leverage (at reasonable rates) in order to stimulate growth and investment.

- Inflation Control – the more currency is put into circulation (relative to goods and services on which such currencies can be spent), the more likely are prices to go up as effectively you have a situation where there is more currency chasing the same number of goods. Sellers of goods and services can raise prices, knowing there is sufficient liquidity in the system for their goods and services to sell at higher prices. The reverse scenario is also true whereby prices are likely to fall and economies slow down when there is less liquidity in the system.

- Currency Value – typically, the faster the money supply increases relative to the demand for it, the actual value of the currency decreases (i.e. depreciates). On the other hand, if the money supply decreases relative to the demand for it, the value of the currency increases (i.e. appreciates).

Who controls the monetary supply?

The central bank controls the monetary supply, typically deriving their authority from governments supported by legislation that define their exact mandate, powers and governance. It is important to note that is most cases, certainly as it pertains to the world’s largest economies such as those included in the G-10, central banks are largely independent to their governments in order to have the necessary authority to manage the monetary policy maintain economic stability irrespective of the prevailing political parties running a country.

Independent Central Banking

Such independence applies for instance for the central banks in the US (Federal Reserve), Canada (Bank of Canada), Europe (ECB), and the UK (Bank of England).

More Centralised Approaches

In Japan while steps have recently been taken to increase independence, there are still close ties with the government. In China, the People’s Bank of China (PBOC) is a state owned entity operating in a political system where the government retains significant influence over all aspects of the economy and the overall financial system.

How is money supply actually managed?

Money supply can be managed and influenced in a number of ways, which can be used independently or at times in combination with one another. Some of the most prominent approaches taken by central banks include the following:

- Fractional-Reserve Banking – this measure is a means to imposing capital requirements on Commercial Banks in order to maintain a set level of deposits in reserve beyond which level such bank deposits can be issued as loans and hence increase the money supply.

- Interest Rate Management – as we have seen recently, the Central Banks set the base rate of interest of a currency. The lower the level (as has been over the past decade) the cheaper the cost of borrowing and the more likely it is for individuals and businesses to borrow and invest money leading to the boosting of the economy. Conversely, as interest rates go up, borrowing becomes more expensive and less attractive, which in turn leads to lower borrowing, less investment and a slowdown in economic growth.

- Discount Rate – on top of interest rate management, Central Banks can also influence the rate at which Commercial Banks can borrow directly from the Central Banks (also known as the “discount window”). Such rates have a direct effect on the ability and willingness of Commercial Banks to lend such assets in order to be able to make a margin for themselves in the process.

- Other tools we have recently seen during times of economic crises, include the purchase of government bonds or other assets (eg. Quantitative Easing) in order to inject liquidity into the economy and boost activity.

How is money supply measured?

The Money Supply can be measured in various ways depending on what is included (or excluded) in such measures at any given point in time. The measures are referred to as M0, M1, M2 and M3 going from the most narrow definition (M0, including only physical “hard” currency) to the broadest definition (M3).

M2 is generally the most and considered to be the most comprehensive as a measure of the amount of money that is available at any given time to be spent or invested in the economy.

M2 includes:

- All hard currency in circulation (coins and notes)

- All current account deposits

- All savings accounts and certificates of deposit.

The different measures are important as they can allow nation states and policy makers to analyse, compare, contrast the money supply of their countries and allow them to take action where necessary.

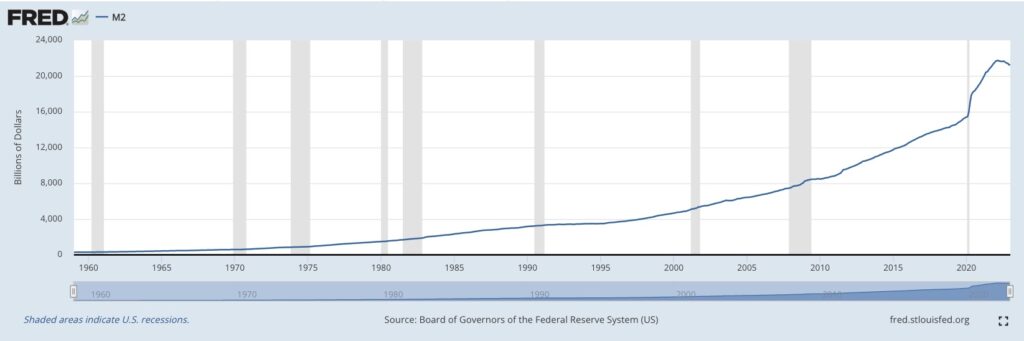

Over the past 15 years, policies of monetary expansion have been noticeably on the rise, with heightened headlines and media coverage across the world. This has been largely due to a number of macroeconomic factors such as the 2008 Great Financial Crisis, the general state of economic turmoil triggered by the COVID crisis and more recently by further distress witnessed through the financial industry most notably with bankruptcies, bank runs and sharp deterioration of confidence in the Banking sector. The below chart shows the acceleration (steepening) of the (M2) monetary base in the US over the past two decades.

Monetary Expansion is driving Inflation

Clearly, while these expansionary monetary policies (coupled by low interest rate regimes) have been implemented with an aim to stabilise financial markets and offer support to domestic and increasingly global economies, we are beginning to see the side effects that come with prolonged monetary expansion. Inflation has been alarmingly on the rise across the world reaching double digit levels even in major economies.

With inflation on the rise, wider risks and alarm bells are setting off too, challenging the stability and survival of families, businesses and entire economic systems.

We have covered inflation, its origins, causes and effects in a bit more detail if you are keen to investigate in this article.

Closing Remarks

The topic of money supply and interlinked inflation is becoming increasingly topical and starting to enter the lexicon of citizens and taxpayers around the world. Certainly, even if the detailed mechanics may escape most, the simple principle is straightforward – the more supply you have of any given asset (with all other things staying equal) the more diluted it becomes and the less it is worth. The effects are starting to show where it matters most: in business’ accounts and individuals’ back pockets.

Let it be clear, with 180+ currencies worldwide and a highly interconnected global economy, it is no easy task for central bankers to coordinate domestic monetary policies to stabilise financial markets and keep inflation and economic stability in check.

The feeling is that the era of domestic currencies, domestic economies and domestic central banks able to orchestrate and manage their own affairs is no longer effective as may have been in the past. A change to the current state of affairs appears imminent to face new sets of challenges and opportunities of the 21st century.

Going back to a gold standard where all currencies were linked and pegged to the value of gold would appear daft and a step backwards. As we know, humanity always evolves and progresses forwards.

With the promise of blockchain, computer science and cryptographically secure systems we might well be entering a new era, a more stable and innovative economic and monetary system that can change the status quo and help us leverage technology to face the growing challenges and opportunities of our times.

We’ll shortly start diving into cryptocurrencies in the following articles.

Stay tuned!